Key sales Tool Features in WinLoan-32

There are two main features contained in the WinLoan-32 software product that

form a powerful combination to help you when working with your customers. Using

the features described in this article will dramatically improve every loan

officer’s ability to arrive at loans which both meet the customer’s needs and

include important payment protection.

There are two main features contained in the WinLoan-32 software product that

form a powerful combination to help you when working with your customers. Using

the features described in this article will dramatically improve every loan

officer’s ability to arrive at loans which both meet the customer’s needs and

include important payment protection.

Menu Selling and the Group Quote

At a recent CIMRO (Credit Insurance Marketing Representatives Organization) conference, one of the speakers managed the insurance group in a major bank. His presentation focused on the key elements involved in maximizing fee income from payment protection sales. One of the slides illustrated the concept of “menu selling”, where the payments and costs for all possible payment protection options are summarised on a single page and presented to the borrower for consideration. He said studies had shown menu selling to be effective in increasing fee income.

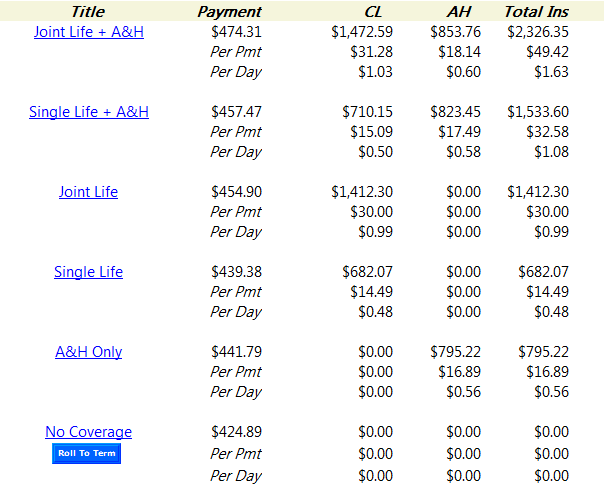

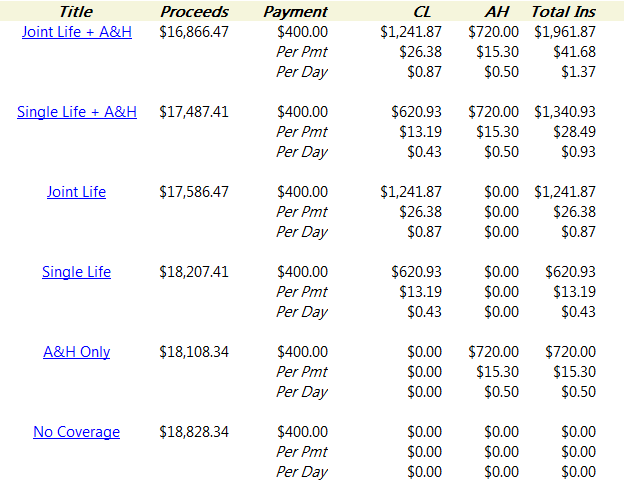

Sitting in the audience, we were excited to hear this because our WinLoan products offer the “Group Quote” screen, which is exactly what he was demonstrating. Take a look at the WinLoan-32 Group Quote screen below for a $20,000.00 loan with 60 monthly payments:

The first step in selling payment protection is to offer it. The Group Quote screen presents the options in descending order of cost, from the highest coverage plan all the way down to no coverage at all. For each option, the cost per payment and cost per day is given, enabling you to put the added expense for the protection in perspective.

The studies referred to above showed that most borrowers will not choose the least expensive (no coverage) option, but rather a step or two above that. Of course, it is the loan officer’s job to explain the benefits of that protection, but the Group Quote provides a clean presentation of the menu of options that will assist the loan officer in this task.

Note that Sherman and Associates will tailor the Group Quote screen to your specifications. The number, order, and description of each protection option offered is completely customizable, and we will work with you to provide the optimal menu of options for your organization. Furthermore, you have the option of automatically enabling the Group Quote screen for every loan calculation quoted by your loan officers. This guarantees that your payment protection options are always available to be offered to the borrower with each and every loan quotation.

Rollback from Desired Payment to the Loan Amount, Term, or Rate

The borrower’s primary concern is the payment amount. WinLoan-32 allows you to enter the borrower’s desired payment and calculate either the loan amount (proceeds) or the number of payments (term), with or without Payment Protection. You can ask the borrower, “What payment amount are you looking for?”, and then work from that payment. This elevates you to a consulting position in the borrower’s mind because you are working with the borrower to arrive at his or her desired payment.

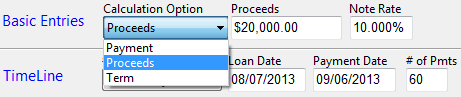

With rollbacks you can easily answer questions such as, “I can afford $400.00 per month. How much car can I buy?”. Using these rollback features creates more customer satisfaction with you and the entire lending process. Below is a sample of how the top section of your WinLoan-32 entry screen might look:

The Calculation Options prompt determines the value which the software will calculate. The default “Payment” option will compute an equal payment loan given a specified rate, proceeds, and term. The other options (“Proceeds”, “Term”, and “Rate” (not shown)) allow the user to specify a desired payment and will then compute the specified option, including any payment protection products in the calculation.

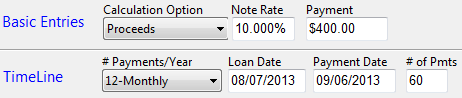

As an example, let’s compute how much a borrower can borrow with a target payment amount of $400.00. Begin by selecting the “Proceeds” calculation option. After selecting “Proceeds”, a new prompt will appear beneath the note rate prompt which will allow you to specify a payment amount. After entering a payment amount of $400.00, the top portion of the entry screen will look something like this:

Combining the Group Quote and Rollback

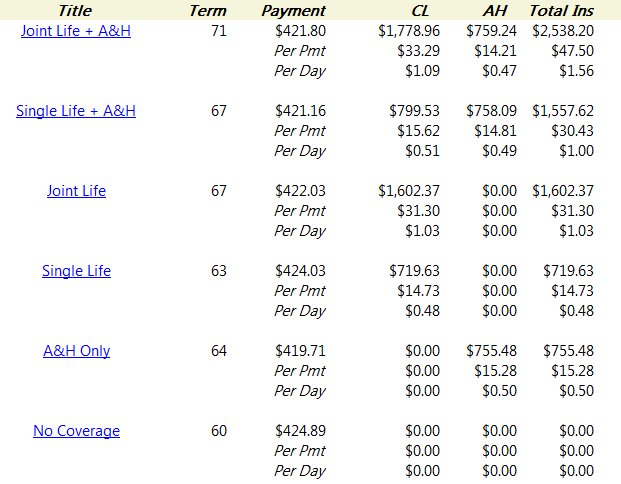

Combining menu selling with rollbacks is an extremely powerful combination. Once you have requested calculation of the proceeds from the entered payment of $400.00, you are presented with a group quote of all possible coverages. Below you can see the Group Quote screen for the rollback to proceeds with a specified payment of $400.00.

You can combine the Group Quote screen with another common rollback - the “roll to term”. A roll to term calculation allows the user to specify a maximum desired payment amount, with the calculation returning the shortest loan term that will produce a payment less than or equal to the payment amount specified. The procedure is exactly the same as that for the roll to proceeds, except you select the “Term” calculation option.

However there is an even easier way to handle the roll to term! Here is the first Group Quote screen’s (from the Menu Selling and the Group Quote Screen section above) bottom line again:

Just under the “No Coverage” title is the  button. Just a single click on

this button replaces several steps on the Entry Screen!

button. Just a single click on

this button replaces several steps on the Entry Screen!

If the borrower wants the “No Coverage” option because it has the lowest

payment, you can say something like this: “I understand. These are difficult

times. But I know you appreciate the value of the Payment Protection. So we can

do this: We’ll stay with that payment, or even something slightly less, but

extend the term just a few months so you can still have the benefit of the

important Protection.” Clicking on  results in the following Group

Quote screen:

results in the following Group

Quote screen:

This approach is very powerful because the borrower has raised an objection and told you his or her desired payment amount. With just one click you’ve satisfied that need and kept the important Payment Protection in the loan. It is a sure winner for both the borrower and the bank!

Contact Us!

Menu Selling through the Group Quote, rollbacks from the customer’s desired payment to other factors in the loan, and the combination of these two features will absolutely increase borrower satisfaction and payment protection sales. Make these features work for you!

If you are interested in these features and are a current or prospective WinLoan-32 partner, please contact us so that we can put the power and flexibility of these tools in your hands.