PMI Now in WinLoan-32 and eWinLoan

J. L. Sherman and Associates is excited to announce the addition of private

mortgage insurance (PMI) support to our best of breed desktop and internet based

loan quotation tools, WinLoan32 and

eWinLoan. Mortgage loans may now be covered with private

mortgage insurance, with premiums paid monthy or as a single premium. Any number

of monthly premiums may be paid up-front. PMI is dropped at a loan to value

ratio (LTV) of 78%, with a warning given at 80%, assuring compliance with

federal regulations. Furthermore, the 78% and 80% values are configurable,

assuring future compliance with federal or organizational needs.

J. L. Sherman and Associates is excited to announce the addition of private

mortgage insurance (PMI) support to our best of breed desktop and internet based

loan quotation tools, WinLoan32 and

eWinLoan. Mortgage loans may now be covered with private

mortgage insurance, with premiums paid monthy or as a single premium. Any number

of monthly premiums may be paid up-front. PMI is dropped at a loan to value

ratio (LTV) of 78%, with a warning given at 80%, assuring compliance with

federal regulations. Furthermore, the 78% and 80% values are configurable,

assuring future compliance with federal or organizational needs.

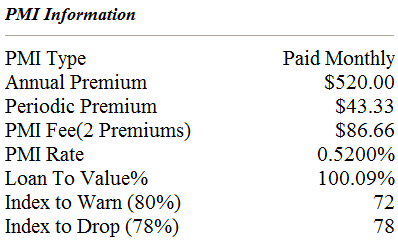

Through our setup files, the PMI module can be highly customized to minimize keyed input and place default values (assumed without having to be entered) on target. In the current environment of cautious lending, PMI is making a resurgence and now WinLoan32 and eWinLoan both provide an easy way to include it with your mortgage loans. Below is a portion of our full disclosure page which illustrates the PMI information provided when PMI is included with a loan:

If you are interested in software which can handle your PMI calculation needs, whether it be the SCEX, WinLoan32, or eWinLoan, please feel free to contact us for further information.